Are you ready to turn your business dreams into reality? A well-crafted business plan is the cornerstone of any successful venture. But how do you write a business plan that attracts investors? Writing a winning business plan can seem daunting, but with the proper guidance, it can become your roadmap to success.

You might have heard this before: “Fail to plan, plan to fail.” A solid business plan is essential for your business to succeed. This is about something other than writing down some ideas on paper. We’re discussing creating a helpful guide to map your business from startup to growth.

.png)

In this blog post, we’ll explain the steps to creating a winning business plan. You’ll learn the essential parts, get tips on market research, and understand how to make financial projections.

By the end, you’ll know how to write a plan that gets attention, secures funding, and helps your business succeed. Plus, we have an exclusive offer for you by the end of this post. Ready to start? Let’s dive in and discover how to write a business plan that wins!

What is a Business Plan?

A business plan is a written document that outlines your business goals and the steps you will take to achieve them. It serves as a roadmap for your business, helping you stay on track and focused.

Moreover, it shows investors and lenders that you have a clear strategy and are serious about your business.

Free Sample Business Plan Template – Get Yours Now!

Why Do Investors Require a Business Plan?

Investors review business plans to assess the viability and potential profitability of a venture before investing. A well-organized plan showcases your vision, thorough market research, and strategic execution, giving investors confidence in your business model and growth potential.

What Do Investors Look for in a Business Plan?

A Clear and Compelling Vision

Investors seek a business with a defined direction. Your long-term objectives and growth strategy should be evident, providing them with confidence in your venture’s future success.

Market Validation and Business Traction

Demonstrating that your product or service has a market demand is critical. Investors want proof of customer interest, sales data, partnerships, or pre-orders that validate your business model.

Financial Needs and Resource Allocation

Transparency in financial planning reassures investors. Clearly outline the funding you require and how you plan to use it, whether for product development, marketing, or scaling operations.

Strong Leadership and Expertise

Investors assess the qualifications and track record of your leadership team. Highlight the skills and experience of your key team members and their roles in executing the business plan successfully.

Strategic Exit Plan

Investors need assurance of potential returns. Outline exit strategies such as acquisitions, IPOs, or buyouts, giving investors a clear understanding of their return on investment.

Essential Documents for Investor Consideration

- Introduction Letter: A professional introduction letter should be concise, engaging, and explain why your business is a promising investment opportunity.

- Business Pitch Deck: A visually appealing pitch deck should summarize key business details, including your value proposition, target market, revenue model, and financial forecasts.

- Executive Summary and Snapshot Plan: An executive summary provides a brief yet informative overview of your business, giving investors key insights at a glance.

- Financial Projections and Analysis: Provide well-supported financial forecasts, including income statements, cash flow projections, and balance sheets to demonstrate financial stability and growth potential.

Why is a Business Plan Important?

A business plan is crucial for any business because it acts as a roadmap, guiding you through each stage of managing your business. A clear vision helps attract investors and stay organized in reaching your goals.

A business plan also helps manage risks by identifying challenges and developing strategies to overcome them. It can also improve decision-making by providing a framework for evaluating opportunities and setting benchmarks to track progress.

Structuring Your Business Plan for Investor Appeal

Executive Overview: Summarize your mission, vision, and unique value proposition in a compelling introduction to grab investor interest.

- Business Opportunity & Problem Solving: Explain the problem your business addresses, its significance, and how your product or service provides an effective solution.

- Industry and Market Insights: Demonstrate your understanding of the industry landscape, customer demographics, and competitive positioning to showcase growth potential.

- Sales and Marketing Approach: Describe your strategy for acquiring and retaining customers, including pricing models, promotional plans, and distribution channels.

- Growth Milestones & Development Plan: Present a timeline outlining key business milestones, including product launches, revenue targets, and expansion phases.

- Leadership & Organizational Structure: Introduce your management team and their qualifications, emphasizing their ability to execute the business strategy.

- Revenue Model and Financial Planning: Provide detailed financial projections, including revenue streams, cost structures, and profitability forecasts to assure investors of sustainability.

- Supporting Documentation: Include relevant materials such as intellectual property details, legal agreements, and comprehensive research data.

Frequently Asked Questions

1. What is the purpose of a business plan?

A business plan outlines your business goals and the steps to achieve them. It acts as a roadmap, helps attract investors, and keeps you organized.

2. How many pages should a business plan be?

A business plan should typically be 15–20 pages long. Keep it concise and include all necessary details.

3. Who can prepare a business plan?

Anyone with a clear vision of their business can prepare a business plan. Business owners, entrepreneurs, and consultants are common authors.

Conclusion

Writing a winning business plan is vital to making your business dreams come true. This post covered what a business plan is, why it’s essential, and the main sections it should have. We provided a simple, step-by-step guide to help you create your plan.

Each part, from the executive summary to the financial projections, helps outline your business goals and strategies. Following these steps will help you attract investors, stay organized, and guide your business to success.

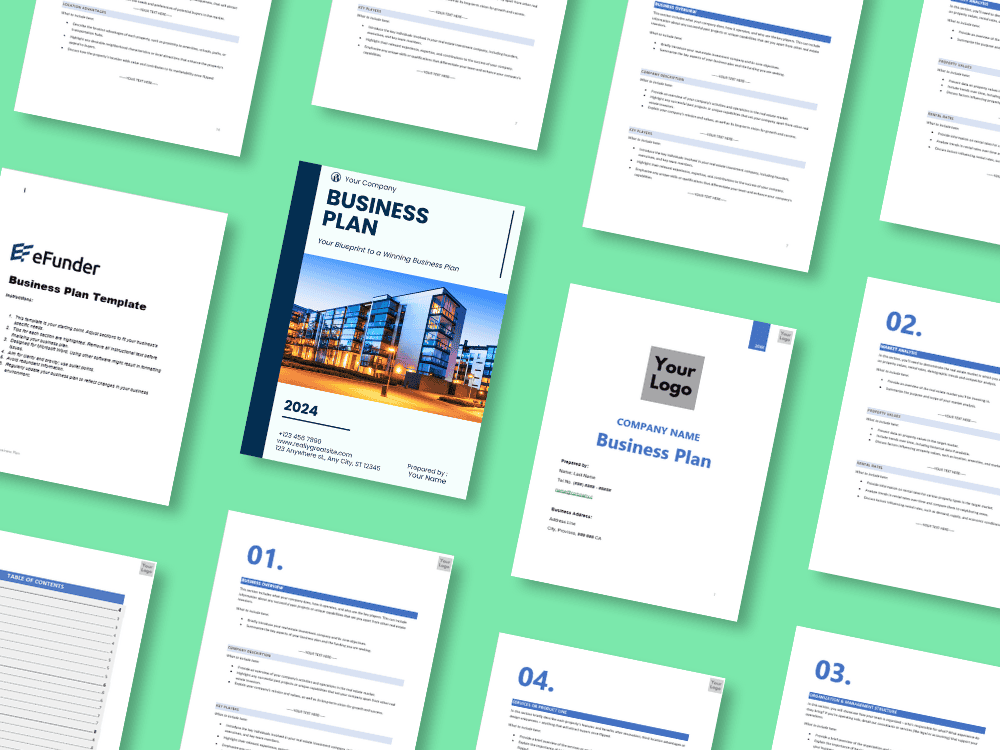

Ready to start? Download our FREE Business Plan Template to make the process easier. If you need financing, schedule a FREE consultation at eFunder to explore your options. Don’t wait—take the first step toward your business success today!

Additionally, don’t miss out on our exclusive offer: a 30-day free trial from Realeflow. Perfect for ambitious investors like you. Click here to seize this opportunity and elevate your investment strategies.

Some of the links in this article may be affiliate links, which can compensate us at no cost if you decide to purchase. This blog is not intended to provide financial advice.