Stepping into the world of property buying or selling, you’re bound to encounter two key players – real estate agents and mortgage brokers.

But what sets them apart? The role of a real estate agent is often mistaken for that of a mortgage broker and vice versa. This mix-up can lead folks down confusing paths. Real estate agents guide you through finding or selling properties, while mortgage brokers are your go-to for securing financing deals.

Getting a good grip on these roles can make navigating through the thick of real estate deals a whole lot smoother. So let’s break it down, shall we?

Dive Deeper into Your Real Estate Potential: As the founder and CEO of eFunder, I bring my extensive experience in real estate and commercial mortgages to enhance your investment strategy. Stay tuned for actionable insights, and don’t miss the exclusive offer at the end of this article, designed to revolutionize your lead generation approach.

Table Of Contents:

- What is a Mortgage Broker?

- The Role of a Real Estate Agent

- Key Differences Between a Mortgage Broker vs. Real Estate Agent

- How Mortgage Brokers and Real Estate Agents Work Together

- Skills Needed for Success as a Mortgage Broker or Real Estate Agent

- FAQs in Relation to Real Estate Agent vs Mortgage Broker

- Conclusion

What is a Mortgage Broker?

When you’re ready to buy a home, you’ll likely need some help securing financing. That’s where a mortgage broker comes in.

A mortgage broker acts as a middleman between you and potential lenders. They work with a variety of lenders to find the best loan products and interest rates to fit your unique needs.

Responsibilities of a Mortgage Broker

A mortgage broker’s main responsibility is to help you secure financing for your home purchase. They do this by:

- Gathering documents from you, including your credit report and income verification

- Helping you assess your financial situation and determine what type of loan best suits your needs

- Submitting your loan application to various lenders to shop for the best deal

- Communicating with lenders on your behalf throughout the loan application process

How Mortgage Brokers Help Clients Secure a Loan

Mortgage brokers have access to a wide range of lenders, including banks, credit unions, and private lenders. By looking around, they can often find better rates and terms than you might be able to get on your own.

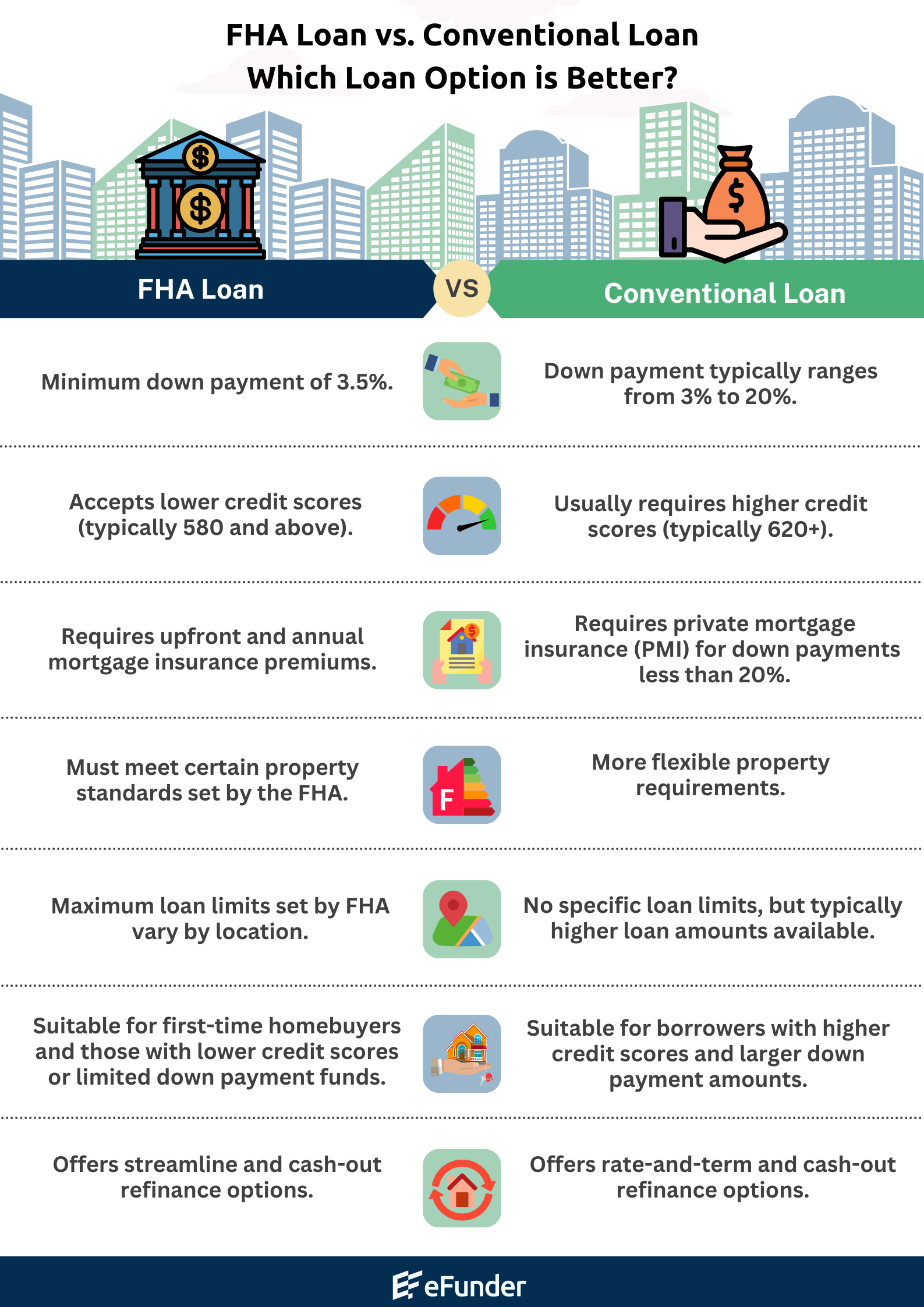

They can also help you navigate the complex world of mortgages, explaining the differences between loan types (like FHA loans vs. conventional loans) and helping you choose the option that works best for your financial situation.

Mortgage Broker Qualifications

To become a mortgage broker, you typically need to:

- Complete 20 hours of pre-licensing education

- Pass the National Mortgage License System (NMLS) exam

- Undergo a background check and get fingerprinted

- Obtain a surety bond or meet state net worth requirements

- Complete additional state-specific requirements, which vary by location

Mortgage brokers are typically paid commission by the lender for their services, so they may not charge you a fee directly.

The Role of a Real Estate Agent

While a mortgage broker focuses on helping you finance your home purchase, a real estate agent helps you actually find and purchase the property.

What Real Estate Agents Do?

Real estate agents wear many hats, but their primary role is to help buyers and sellers navigate the home buying or selling process. For buyers, this typically involves:

- Helping you determine your must-haves and nice-to-haves in a home

- Searching listings to find homes that meet your criteria

- Scheduling and attending showings with you

- Advising you on offer price and terms

- Negotiating with the seller on your behalf

- Guiding you through the closing process

For sellers, a real estate agent typically:

- Helps you price your home competitively

- Markets your home through listing it on the MLS, hosting open houses, etc.

- Negotiates with buyers on your behalf

- Advises you on the sell

Real Estate Agent Qualifications

To become a licensed real estate agent, you typically need to:

- Be at least 18 years old

- Complete your required prelicensing education (which varies by state)

- Pass your state real estate license exam

- Find a real estate broker to work under

- Join the local MLS

Real estate agents usually earn money through commissions – a percentage of the final sale price of the home. So the more expensive the home or the more homes they help buy or sell, the more money they can earn.

How Real Estate Agents Help Buyers and Sellers

For most people, a home is the largest financial investment they’ll ever make. Real estate agents help protect that investment by offering their expertise, resources, and skills to guide clients through the buying or selling process.

They have in-depth knowledge of the local real estate market and can help clients set realistic expectations, meet their goals, and avoid costly mistakes. They also handle scheduling, paperwork, and negotiations, helping to relieve some of the stress of buying or selling a home.

Key Differences Between a Mortgage Broker vs. Real Estate Agent

While there is some overlap between what mortgage brokers and real estate agents do, there are also some key differences between these two roles.

Responsibilities

The biggest difference between a mortgage broker and a real estate agent is what they help you with. A mortgage broker’s main job is to help you secure financing for a home, while a real estate agent helps you find and purchase the actual property.

Mortgage brokers focus on the financial side – compiling your loan application, coordinating with lenders, and finding you the best possible rates and terms.

Real estate agents, on the other hand, focus on the property itself. They help you find homes that fit your needs and budget, schedule showings, submit offers, and negotiate with sellers on your behalf.

Work Environment

Both mortgage brokers and real estate agents often work independently and on commission. However, their day-to-day work environments can look quite different.

Mortgage brokers tend to work more regular business hours and spend much of their time in an office, meeting with clients, processing paperwork, and communicating with lenders.

Real estate agents’ schedules tend to be more flexible and include lots of time outside the office – showing properties to buyers, hosting open houses for sellers, and traveling to and from meetings.

Licensing and Education Requirements

To become a mortgage broker, you need to:

- Complete 20 hours of pre-licensing education

- Pass the NMLS exam

- Undergo a background check

- Meet bonding and net worth requirements (which vary by state)

To become a real estate agent, requirements vary by state but usually include:

- Completing between 30-90 hours of pre-licensing education

- Passing the state real estate license exam

- Finding a broker to sponsor you

So while there are similarities, the licensing and education requirements aren’t identical. Mortgage brokers may need to be more well-versed in finance and lending regulations, while real estate agents need a deeper knowledge of their local housing market and real estate laws.

How Mortgage Brokers and Real Estate Agents Work Together

Real estate agents and mortgage brokers are like the dynamic duo of the real estate world. They’re the Batman and Robin of property transactions, if you will.

But how exactly do they work together to make the home buying and selling process a success? Let’s break it down:

The Home Buying Process

When it comes to buying a home, real estate agents are the first point of contact. They help buyers find properties that fit their budget and wish list.

Once a buyer falls in love with a home and is ready to make an offer, that’s when the mortgage broker steps in. They work with the buyer to secure financing for the purchase.

The mortgage broker will assess the buyer’s financial situation, including their credit score and income, to determine which loan products they qualify for. They’ll then shop around to find the best rates and terms from various lenders.

Meanwhile, the real estate agent will negotiate with the seller on behalf of the buyer to get the best possible price and terms for the home.

The Home Selling Process

On the flip side, when it comes to selling a home, the real estate agent takes the lead. They’ll work with the seller to determine a competitive price for the property and develop a marketing strategy to attract potential buyers.

Once an offer comes in, the real estate agent will negotiate with the buyer’s agent to ensure their client gets the best deal possible. They’ll also work with the seller to navigate any contingencies or issues that arise during the real estate transaction.

If the buyer needs financing, the mortgage broker will step in to assist them in securing a loan. They’ll work closely with the buyer and their agent to ensure a smooth and timely closing.

Collaborating for a Successful Transaction

Ultimately, real estate agents and mortgage brokers have the same goal: to help their clients achieve their homeownership dreams. And they know that collaboration is key to making that happen.

Real estate agents often have a network of trusted mortgage brokers they recommend to their clients. They know which brokers have a track record of success and can get the job done efficiently.

Mortgage brokers, in turn, rely on referrals from real estate agents to grow their business. They know that by providing excellent service to agents’ clients, they’ll be more likely to receive future referrals.

Together, real estate agents and mortgage brokers form a powerful team that can navigate even the most complex real estate transactions. By working hand in hand, they ensure a smooth and successful experience for everyone involved.

Skills Needed for Success as a Mortgage Broker or Real Estate Agent

So, you’re thinking about becoming a mortgage broker or real estate agent? Congratulations. You’re about to embark on a rewarding career path that can be both challenging and fulfilling.

But before you dive in head first, it’s important to understand the skills you’ll need to succeed in these roles. Here are a few key qualities that top-performing mortgage brokers and real estate agents share:

Customer Service

At the end of the day, mortgage brokers and real estate agents are in the business of helping people. Whether you’re assisting a first-time homebuyer or a seasoned investor, providing excellent customer service is essential.

This means being responsive to your clients’ needs, communicating clearly and regularly, and going above and beyond to ensure a positive experience. It also means being patient, empathetic, and understanding, even when deals get stressful or complicated.

Local Market Knowledge

To be successful as a mortgage broker or real estate agent, you need to know your local market inside and out. This means staying up-to-date on market trends, understanding the nuances of different neighborhoods, and being able to provide valuable insights to your clients.

Whether you’re helping a buyer find their dream home or advising a seller on pricing strategy, your local market knowledge will be invaluable. So, make it a priority to attend industry events, read market reports, and network with other professionals in your area.

Critical Thinking and Problem Solving

No two real estate transactions are exactly alike, and there will inevitably be challenges and obstacles along the way. That’s where critical thinking and problem-solving skills come in.

As a mortgage broker or real estate agent, you’ll need to be able to think on your feet and come up with creative solutions to keep deals moving forward. This might mean finding alternative financing options for a buyer with a unique financial situation, or negotiating with a difficult seller to keep a deal from falling through.

Communication and Negotiation

Effective communication and negotiation skills are essential for success in both the mortgage and real estate industries. You’ll need to be able to clearly explain complex financial concepts to your clients, and advocate for their best interests in negotiations with lenders or other parties.

This means being an active listener, asking the right questions, and being able to adapt your communication style to different personalities and situations. It also means being confident in your abilities and not being afraid to stand your ground when necessary.

Continuous Learning and Adaptability

Finally, to succeed as a mortgage broker or real estate agent, you need to be committed to continuous learning and professional development. The industry is constantly evolving, with new regulations, technologies, and best practices emerging all the time.

To stay ahead of the curve, you’ll need to be proactive about seeking out educational opportunities and staying up-to-date on industry trends. This might mean attending conferences and workshops, earning additional certifications, or simply reading industry publications and blogs.

You’ll also need to be adaptable and willing to embrace change. Whether it’s a shift in market conditions or a new technology platform, being able to pivot quickly and adjust your approach will be key to long-term success.

To thrive as either, hone skills like customer service, local market insights, problem-solving, communication, negotiation, continuous learning and adaptability for success in the ever-changing real estate landscape.

FAQs in Relation to Real Estate Agent vs Mortgage Broker

What is the difference between a real estate agent and a mortgage broker?

A real estate agent assists you in finding and purchasing or selling a property, whereas a mortgage broker connects you with lenders to secure financing.

What is the difference between a broker and a real estate agent?

A broker possesses more training, has the ability to run their own firm, and employs agents. Conversely, an agent operates under brokers to sell properties.

Is it good to be a mortgage broker?

Indeed, if you are proficient in finance matchmaking. It’s fulfilling to assist individuals in securing loans for their dream homes or investments.

What is the difference between a lender and a mortgage broker?

Lenders directly provide loans. Mortgage brokers, on the other hand, shop around on your behalf to find the best loan deals from various lenders.

Conclusion

In our journey exploring the realm where real estate agent vs mortgage broker battle it out for significance, one thing becomes clear – both have indispensable roles in making dreams come true on either side of the property fence.

The narrative has shown us that whether you’re trying to land your dream home or get buyers competing over your listing, knowing who does what unlocks doors to smoother transactions. While an agent gets knee-deep into local markets hunting gems or showcasing your pride-and-joy under the best light possible; it’s the broker who turns those dollar-sign eyes into tangible offers by weaving through financial labyrinths with ease.

This isn’t about choosing sides but rather appreciating how each player brings something unique to the table – complementing each other’s moves like chess pieces towards checkmate against challenges thrown by today’s market dynamics.

Take the first step towards transforming your real estate dreams into reality with eFunder. Click here to schedule a personalized consultation and discover how we can help you secure the optimal financing for your next investment venture. Let’s build your success story together!

Additionally, don’t miss out on our exclusive offer – a 30-day free trial from Realeflow, specifically tailored for ambitious investors like you. Click here to seize this opportunity and elevate your investment strategies.

Affiliate Disclosure: Please be aware that the link above is an affiliate link. At no additional cost to you, I will earn a commission if you decide to sign up for Realeflow using this link. I recommend this service because of its potential value to you as an investor, not because of the small commission I receive. Your support in using these links enables me to continue providing valuable content and helps grow our community. Thank you!